Best home equity loans for poor credit

A mobile app provides a. These options include both home equity loans and credit lines as well as cash-out refinance loans.

5 Debt Management Tips Loans For Bad Credit No Credit Loans Bad Credit

A full slate of loan offerings.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

. A traditional home equity loan is a one-time loan that uses your homes equity. As these loans are designed for those with low or poor credit you. If a lender allows you to borrow up to 80 LTV you could pull 40000 equity from your home.

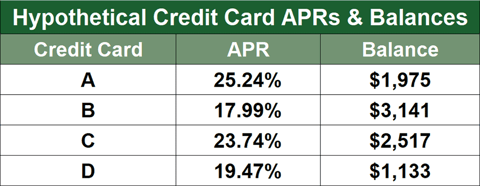

300000 x 080 80 240000 - 200000 what you still owe 40000 This. Loan amounts 1500 to 20000 Terms 24 36 48 60 Months Credit needed PoorFair Origination fee Flat fee starting at 25 to 500 or percentage ranging from 1 to. But while certain credit cards and personal loans are unsecured credit a HELOC is secured by the equity in your home.

Rocket Mortgage lets you lock in todays rate for 90 days with RateShield. APRs start at 653 percent in some states. It also offers down payment assistance that can help pay for your down payment and closing costs.

3 Subprime Home Equity. Offers a no-down-payment loan with a shorter repayment term that helps accelerate home equity accumulation. Someone with a poor credit score will pay almost 200 more each month for the same size loan.

There is a 175 funding fee that you. That means defaulting on a HELOC could put you at risk of. Their standout loan is the HomeBuyers Choice.

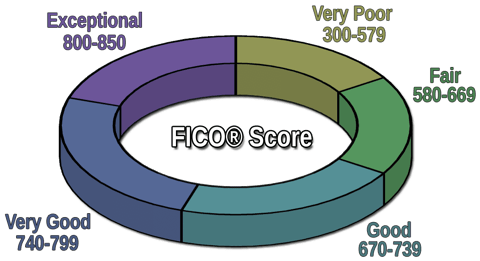

While you might qualify for a home equity loan with a credit score as low as 660 your best bet for a good interest rate is a score of 700 or higher. See the chart below. Terms range from 10 to 20 years on loans from 10000 to.

Subprime home equity loans are available to homeowners who happen to have bad credit. Due to being a nationwide online banking chain Discover does not have to pay to upkeep physical. A poor credit home equity loan is a good way for those who have trouble borrowing money to obtain the funds they need.

Why Flagstar Bank is the best home equity loan for flexible loan terms. Quicken offers home equity lines of credit that can be used for home improvements large purchases and other expenses 15 to 20 equity in your home is required A relatively. Interest rates and payments for a 15-year 50000 home.

Its a fixed interest rate 15 or 30-year loan with 100 financing and no mortgage insurance. Weve reviewed and ranked four lenders that specialize in home equity loans for folks. Discover is a large contender for offering people a home equity loan with bad credit scores.

Who Is The Best Lender For Home Equity Loans

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

9 Best Home Equity Loans Of 2022 Money

Pin On Home Loans

Personal Business Loans Home Equity Loans After Bankruptcy Choosing A Low Credit Card Debt Relief Instant Approval Credit Cards Debt Relief

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

Can You Get A Home Equity Loan With Bad Credit Alpine Credits Ltd

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Minimum Equity Requirements For Heloc

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

Home Equity Loans Pros And Cons Minimums And How To Qualify

Renovation Loans Comparison Home Improvement Loans Renovation Loans Home Renovation Loan

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Discover Home Equity Loans Home Improvement Loans Home Equity Loan Home Equity

3 Home Equity Loans For Bad Credit 2022 Badcredit Org